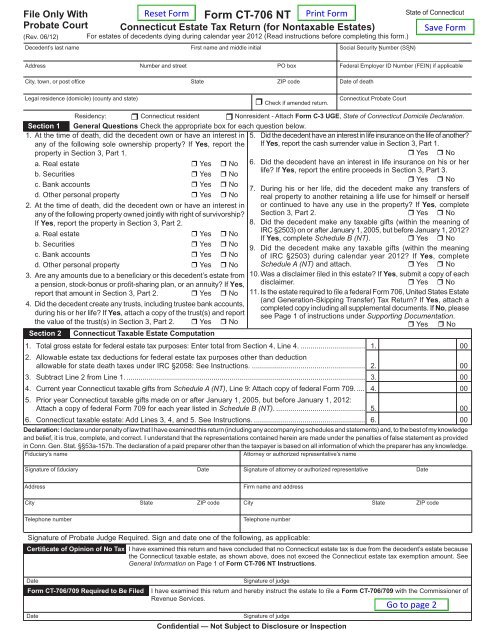

Instructions for Form ET-706 New York State Estate Tax Return For an estate of an individual who died on or after January 1, 202

Instructions for Form ET-706 New York State Estate Tax Return For the estate of an individual who died on or after April 1, 2015

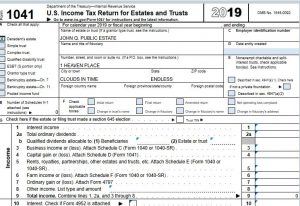

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)

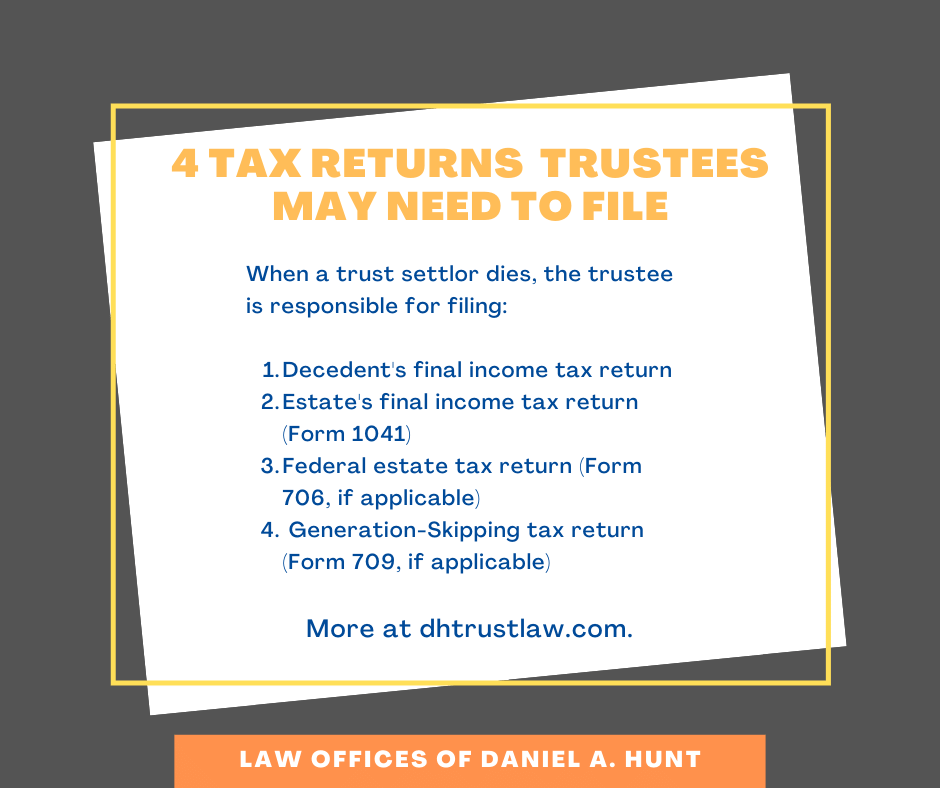

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

![Estate Tax Rates & Forms for 2022: State by State [Table] » Estate Tax Rates & Forms for 2022: State by State [Table] »](https://estatecpa.com/wp-content/uploads/2022/01/washing-estate-tax-300x169.png)